Your Emergency Fund – How Much, Plus Why, How, and Where

A cash reserve is your first responder in times of need and can prevent further financial harm and help to keep your long-term financial plan intact. If you do find yourself on shaky financial footings, this can serve as a stopgap until you regain balance. It will also help you reduce the temptation to raid your long-term assets to meet your near-term need, such as withdrawing funds from your 401(k). There are also psychological effects of having a healthy cash reserve and knowing how much of an emergency fund you have and need. Knowing you have a safe and secure stockpile outside of the stock market may prevent you from making imprudent actions with your long-term investments during times of volatility.

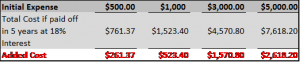

Now is the time to prioritize it if you do not already have one. Tires wear out, water heaters die, roofs leak, and it’s important to be prepared for those eventualities so you’re not scrambling for cash or charge it on high-interest rate credit cards. This may sound obvious, but it is much cheaper to pay for things with cash than to charge it and pay it off over time. The table below illustrates just how expensive paying for something with a credit card and paying it off slowly can be.

If you’re building an emergency fund or you already have some savings, the big question is- how much emergency fund should you have set aside? A good rule of thumb is to target three to six months’ worth of non-discretionary expenses. Non-discretionary expenses include rent or mortgage, utilities, insurance, groceries, and car payments. The exact amount will be different depending on your stage in life and the industry you work in. Such as if you work in an industry that is prone to big swings in economic activity, like the energy sector, you may want to carry a little more than others. Further, if you are nearing retirement, you may want to have a higher percentage of your overall portfolio in cash, knowing you will withdraw some funds for retirement, in the event we encounter tough economic times. This is a concept to manage sequence risk to try to avoid having to sell assets into a bear market.

Maintaining a tight household budget during times of feast can take some discipline. First and foremost, with the overarching theme of developing good spending habits, one needs to make building this emergency fund a priority. Look to your spending patterns and expenditures and see where you might be able to trim and reallocate- and be honest with yourself. An easy way to give your savings a boost are tax refunds if you receive one. The same concept applies if you get a bonus payment at work. You could also try to make things fun and challenge yourself, take the 52-week challenge: The first week set aside $1 and each week for one year increase your savings by $1. By the end of the challenge, you will have almost $1,400 saved. If you think you can start at $15, great, you will have saved over $2,100! Technology can also lend a helping hand. There are many apps such as Acorns and Mint that can be utilized to help with your budgeting and saving endeavors.

The final piece of this is what to do with it once you have this emergency fund. By definition, we can’t predict when you will need this money so it must be readily accessible and liquid. Look to savings accounts or money markets as good vehicles to store your cash reserve but separate from your daily checking account. Lastly, it is also a good idea to have your spouse or trusted family member listed and have access to the account in the event you are unable to take care of the cost yourself.