Time on Your Side: Millennials + Compound Interest = Retirement Success

Let’s start from the beginning…

So what is compound interest and how will it help? Compound interest is the process of earning money, reinvesting that money, and then that money earning more money on itself. In order for the process to work, it requires 1) Reinvesting the earnings and 2) Time. Time is one of the greatest assets that people in their 20s and 30s have at their disposal. Millennials have the advantage of decades left in the workforce, which is critical toward getting retirement savings on the right track.

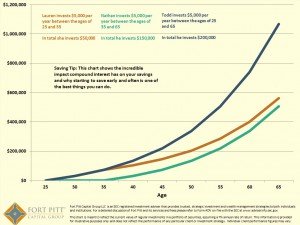

Take “Todd” for example in our graph below. Todd invests $5,000 annually between the ages 25-65. If he receives a 7 percent return each year, he will have over $1 million before retirement. Now take a look at “Lauren” – who also invests $5,000 a year but only between the ages of 25-35. By the time she reaches retirement (at 65 alongside Todd) she will only have around $560,000, but still has more than “Nathan” who waited until 35 to begin saving.

Set yourself up for success

Understanding the basics behind compound interest, there are a few strategies that millennials can use to help bolster their retirement savings effort. For those enrolled in a 401(k) plan with their employer, contribute enough, at least, to maximize the employer match…otherwise you are leaving money on the table. To go along with this point, annually increase contributions in this account and inevitably strive to max out the account (which as of 2015, is $18,000 per year).

In addition, we believe millennials should consider Roth IRA or traditional IRA options and funnel money into an investment portfolio that is mostly made up of equities that can provide long-term asset growth. When it comes to investing — especially for investors in their 20s and 30s — it’s vital to remember that volatility is fleeting. There will be market rallies and dips, but millennial investors have a 20+ year time horizon, so downturns should not be a reason to shy away from the market.

Millennials have time on their side, and by taking advantage of compound interest, not only would Albert be proud, but your future self will thank you.