Investment Market Commentary for Q2 2024

The S&P 500 Index advanced by 4.3% in the second quarter. The market cap weighted S&P was well supported by the strong performance and high weightings of the mega-cap technology stocks as “AI” – Artificial Intelligence enthusiasm dominated the market narrative. However, in stark contrast to the previous two quarters, market breadth and participation among sectors, geographies, and market capitalization were extremely poor. As detailed below, quarterly returns for most equity market indices were in negative territory.

| Index | Q2 Return |

| MSCI EAFE – International | -0.4% |

| Dow Jones Industrial Average | -1.3% |

| S&P 500 Equal Weighted | -2.6% |

| S&P 400 Mid Cap | -3.5% |

| S&P 600 Small-Cap | -3.1% |

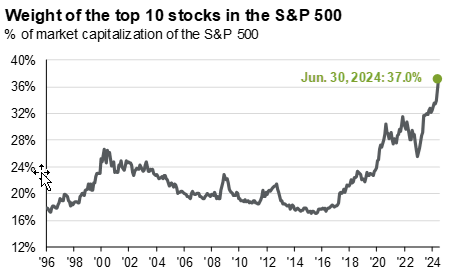

AI momentum stole the show in the second quarter and disproportionately benefited the S&P 500 Index. However, those results have also increased the concentration level of the S&P to a 50-year high, with the top 10 stocks representing 37% of the entire index.

* Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. The top 10 S&P 500 companies are based on the 10 largest index constituents at the beginning of each month. As of 6/30/2024, the top 10 companies in the index were MSFT (7.0%), AAPL (6.3%), NVDA (6.1%), AMZN (3.6%), META (2.3%), GOOGL (2.3%), GOOG (1.9%), BRK.B (1.7%), LLY (1.5%), JPM (1.3%) and AVGO (1.3%). The remaining stocks represent the rest of the 492 companies in the S&P 500. |

Wall Street has fully embraced AI as the most transformative technological innovation in history. However, the conclusion also seems to be that all the economic benefits will accrue to only a handful of companies that produce high-powered semiconductors and run the data centers. Those two conclusions are starkly at odds with each other. Meaningful technological advances, such as the internet a quarter of a century ago, resulted in productivity gains, increased monetization opportunities, and new growth verticals across a broad swath of industries. If AI is to be worthy of the lofty expectations, AI customers will need to realize structural benefits in the form of higher growth rates and profit margins. At present, we see little evidence of any meaningful valuation premium assigned to companies adopting and investing in AI technology to increase their efficiency. We expect equity markets to reward a broader group of companies across a wider range of industries as they demonstrate successful integration and achievements with these new capabilities.

Fixed income returns were mixed in the quarter. Bond prices declined as interest rates rose modestly across the yield curve. However, higher coupon income was an offset to those bond price declines.

Recent economic reports aligned well with the soft economic landing expectation. The data reflected an economy that is softening but not falling off a cliff. While still healthy, the job market is slowing and becoming less tight. We ended the quarter with a three-month average job growth, falling to the lowest level since January 2021. Consumer spending is also cooling in an orderly fashion. Consumers show signs of inflation fatigue as they trade down to more value-oriented options and delay big-ticket purchases. Several prominent retailers continued to cut prices across a wide range of products, noting an increasingly stretched consumer. Estimates for the second quarter GDP growth rate have been volatile but currently stand at 1.5%, little changed compared to the growth rate for the first quarter.

While the economic data has been disappointing, the good news is slower growth (and tighter Fed policy) is helping to bring inflation down. The Federal Reserve’s preferred inflation measure (core PCE – personal consumption expenditures) increased 2.6% on a year-over-year basis in May. This represented the lowest annual rate since March 2021. Slowing economic growth, normalization in the labor market, and inflation moving (perhaps grudgingly) lower should set the stage for the Federal Reserve to start cutting interest rates at some point in the back half of the year.