Is an ESOP right for your business?

Click Here to Request a consultation about an ESOP for your Business

Section 1. ESOP Overview

By Doug Ellis

Important ESOP Numbers:

- There are roughly 6,500 ESOPs covering more than 14 million participants

- Publix Super Markets

- Black & Veatch

- Jasper Engines & Transmissions

- 57% of ESOPs are in S corporations

- Industries of ESOP Sponsors

- Manufacturing – 21%

- Professional/Sci./Tech. – 21%

- Construction – 15%

- Finance/Insurance/Real Estate – 12%

Source: NCEO

Common Misconceptions about ESOPs:

- ESOP is primarily an employee benefit plan

- A selling shareholder must sell 100% of his/her stock

- Shareholders can get a higher price selling to a third party

- Sensitive information must be shared

- Selling stock to an ESOP results in a loss of control by the owner

- Can only be established for a C corporation

- ESOP participants are able to exercise voting rights

- ESOPs make sales to a third party difficult

- ESOP repurchase liability may harm the future of the Company

- Too costly to implement and administer

Contact us today to start a conversation about an ESOP for your business

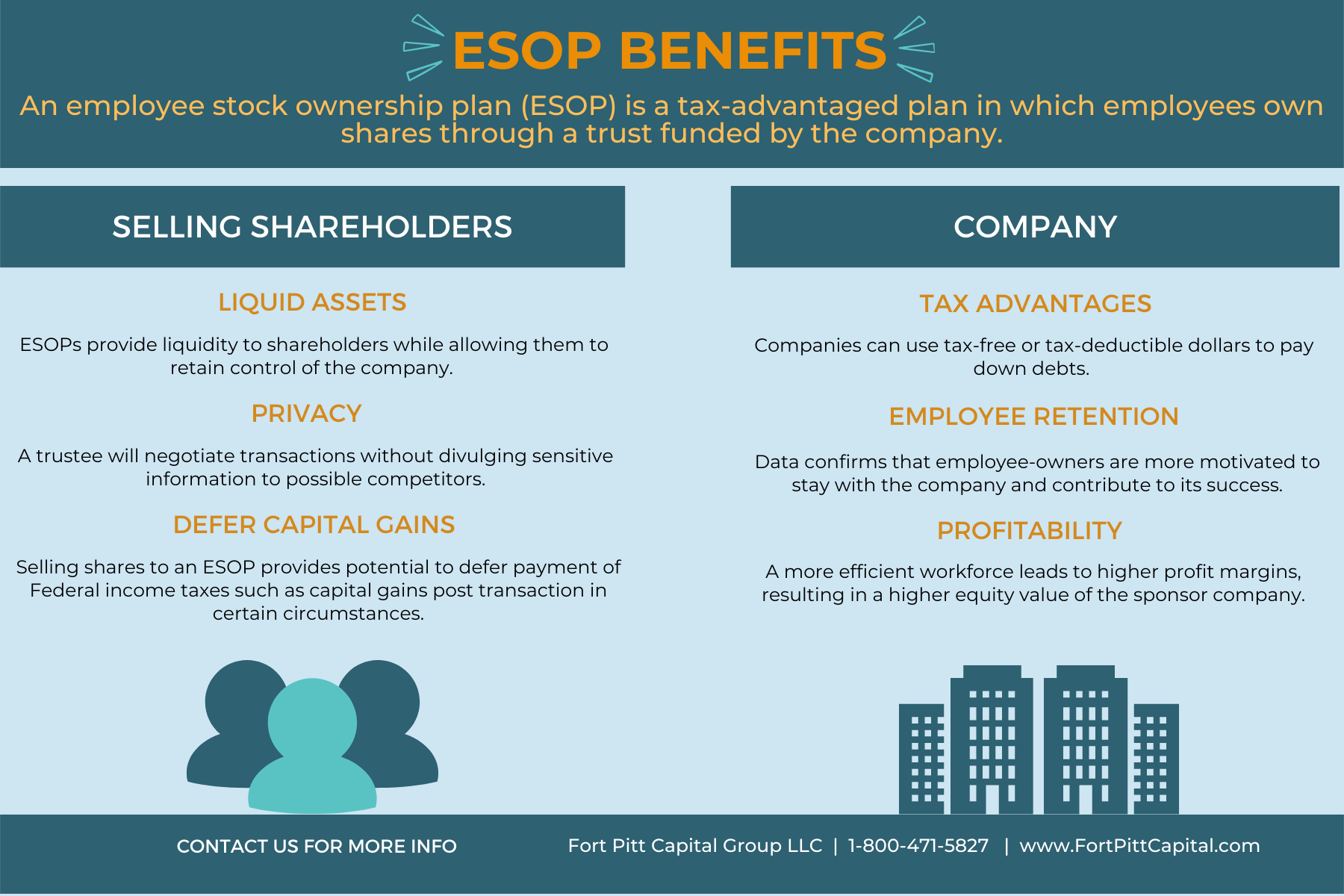

Benefits of an ESOP

o Selling Owners

- Provides ready market to sell shares at fair market value

- Effective means for exiting the Company for controlling shareholders

- Significant tax benefits to selling owners; potentially tax-free sale

- Allows selling shareholders to retain voting control

o Company

- Effective means for succession ‒ continuity of management team

- An incentive for recruiting/retaining employees and a way to increase employee morale and productivity

- Reduction of corporate taxes and increase in cash flow

- Pre-tax dollars to finance repayment of debt

- Finance corporate acquisitions

o Employees

- Employees acquire beneficial ownership in the Company without having to invest their own money

- Employees are able to acquire ESOP stock without paying current income tax on the stock

- Growth of employees’ interest not subject to tax until distribution

- Employees share in current and future economic rewards of Company ownership

- Builds loyalty and motivates performance

o What is an ESOP process?

- Feasibility study

- Identify Trustees, Experts & Advisors

- Financing

- Appraisal

- Plan Design

- Legal Documents

- Closing

- IRS Determination Letter

- Plan Administration (Testing, Annual Valuation, Etc.)

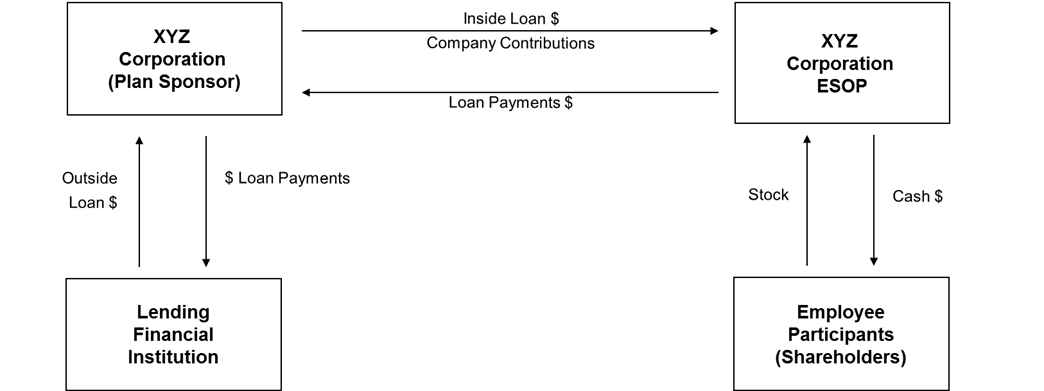

o How do ESOPs help leverage transactions?

- The company establishes an ESOP Trust (the Trustee can be an insider but should use an independent trustee for the Trust’s purchase of Company stock)

- Financing established – Bank and/or selling shareholders

- The company uses bank or seller financing (“External Loan”) to make a loan to the ESOP Trustee (“Internal Loan”)

- The trustee uses Internal Loan proceeds to purchase company stock from the shareholders or the company

- The company makes annual contributions or dividends to ESOP that ESOP uses to repay Internal Loan and allocate the corresponding number of shares to ESOP participants

- Company or ESOP repurchases shares from employees after termination

ESOP Overview – Leveraged Transaction

Section 2: ESOP Tax & Valuation Considerations

by Melissa Bizyak, CPA/ABV/CFF, CVA

ESOP trustees/fiduciaries should appoint valuation experts that:

- Are qualified,

- Are independent, and

- Meet requirements of both IRS and ERISA

ESOP Valuation Fundamentals

- What is “adequate consideration”?

- Valuator must consider factors that are specifically applicable to ESOPs

- ESOP Valuation Fundamentals

- Analyze forecasts provided by the management of the sponsor company

- Valuator should consider all approaches

- Perform an analysis of the transaction to determine the sponsor company’s ability to service debt associated with a transaction

- Issue fairness opinion relative to:

- Transaction price not greater than fair market value

- Reasonableness of interest rates

- Terms of the transaction are fair and reasonable to ESOP from a financial point of view

ESOP’s Tax Benefits to Shareholders

- Can sell any % of the Company to the ESOP for “adequate consideration”

- Will defer tax as long the ESOP owns at least 30% of the Company after the sale (IRC section 1042)

- Must invest the proceeds in qualified replacement property (can choose the amount to be taxed)

- Will receive greater investment income since no tax will be paid and more will be invested

ESOP’s Tax Benefits to Company

- Can take federal and PA corporate tax deductions for both the interest and principal payments on loans borrowed to fund the purchase of Company shares

- Annual contributions to the plan are tax-deductible

- Dividends paid in cash on shares held by an ESOP can be tax deductible by sponsoring corporation

- ESOPs can qualify as shareholders in an S corporation

- S corporation’s percentage of ownership held by ESOP is not subject to income tax at the federal level

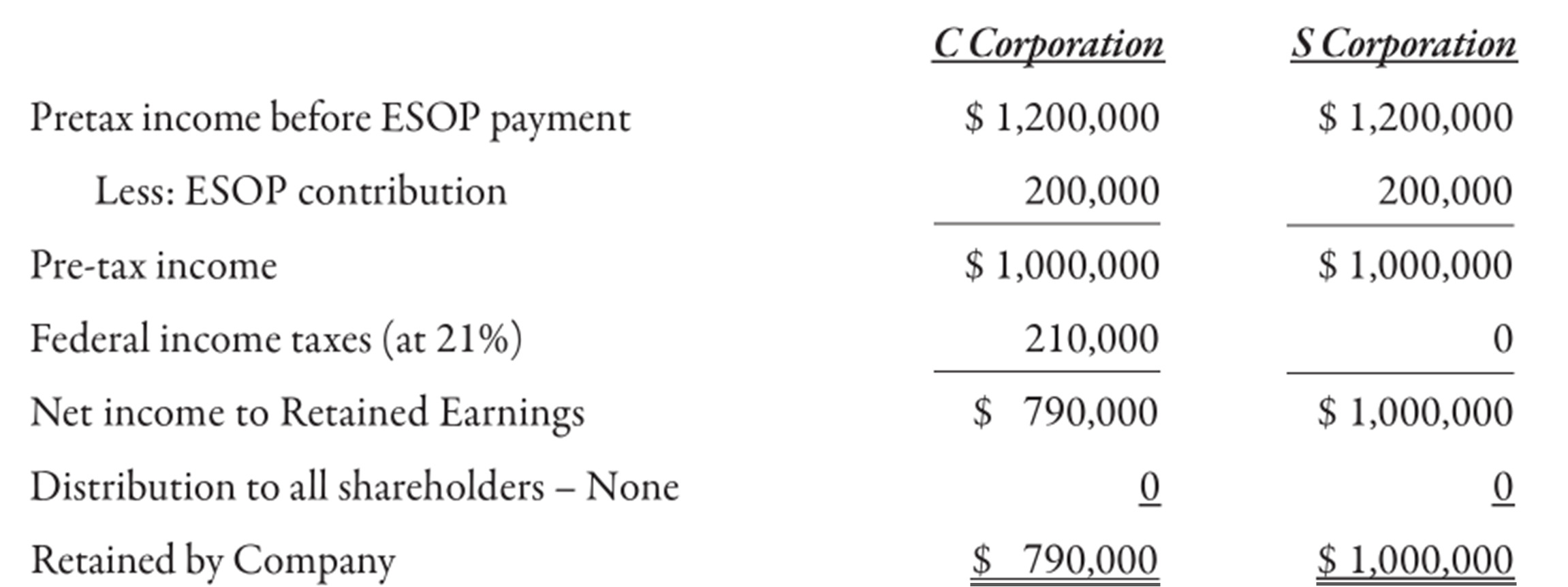

Special Tax Incentives for S Corporation ESOPs

- Non-taxable income related to ESOP stock for S corporations

- S corporation is a “pass-through” entity

- ESOP, as a tax-exempt qualified retirement plan, has no Federal income tax liability – participants pay income tax on distributions

- Thus, an S corporation that is 100%-owned by an ESOP pays no Federal income tax

- Assets in ESOP increase free of income taxes until withdrawal

Comparison of the impact of exemption for taxes for an S corporation ESOP versus a C corporation ESOP (100% ESOP-owned)

Section 3: ESOP Legal Considerations

by Doug Ellis

As a qualified retirement plan, ESOP gives rise to numerous fiduciary and administrative obligations

- Annual valuation

- Annual recordkeeping and administration – Form 5500 filings, audit

- Participant diversification and put rights

- Repurchase obligations

- Communications training and education

- Evaluating offers to buy the company

- Legal compliance

- ESOP participation may be subject to certain eligibility requirements

- ESOP may require participants to meet certain service requirements to “vest” in his or her benefit or receive allocations of stock

- Participants may defer distribution of benefits if they leave the Company before reaching retirement age (get a “free ride”)

- The company can maintain the existing management structure but must be aware of different ESOP & corporate fiduciary roles

- Selling shareholders can continue to receive salary and/or phantom equity grants

Personal Financial Planning: Will an ESOP work for you?

By Chris Chaney

- Identify anticipated expenses

- This is more difficult to estimate if there will be a change in lifestyle

- Rationalize expenses:

- Identify expenses you will need to assume that were previously run through the business. Which will you assume going forward? Which will you be able to eliminate?

- Identify income that may be adjusted post-transition (e.g., rental income if you own the property, etc.)

- Expenses resulting from a major purchase (second home, aircraft, etc.) or a change in lifestyle (travel)?

The goal is to define, as well as you can, your anticipated living expenses after you leave the business.

- Identify Your Assets and Income

- External (Non-portfolio) sources of cash flow:

- Will you continue working?

- Social Security benefits

- Pension benefit(s)?

- Rental income

- IF retaining real estate: how reliable? How much? How long?

- Identify portfolio income need:

- Net proceeds

- Ideally, your annual cash flow is 2-3% of your overall portfolio value.

- Determine the amount of assets needed to underwrite your NEED.

- All businesses have cycles – yours, as well as publicly traded companies (stocks). Every company faces adverse circumstances – from occasional headwinds and challenging environments to unexpected competition, unforeseen issues, or disruptive developments.

It is important to build an “all-weather” portfolio OUTSIDE of your business.

-

- A good place to start: Employer-sponsored retirement plan

- Surplus: non-qualified investments.

- Estimated NET ESOP proceeds.

- Liquidity Event: Business Sale through an ESOP

- If you meet all of the requirements, you MIGHT be able to consider a 1042 exchange.

- If you do not, then the anticipated ESOP cash flow will need to be incorporated into your retirement plans.

- Assess the tax impact

- Work with your tax advisor to determine – and if possible, minimize – the potential tax impact of the sale.

- A 1042 Exchange can help to defer or avoid capital gains taxes.

- If outright distributions: determine your net proceeds and how much should be set aside to pay the tax bill.

- Consider strategies to mitigate taxes:

- Retirement plan contributions

- Charitable giving – this kind of planning requires great care and must be tailored to your circumstances, concerns and goals.

- Investment Strategy: Optimize Assets Based on Need, Goals

- After-tax assets (least expensive to access from a tax perspective): most conservative.

- Allocate 6-9 years of anticipated distributions to non-growth assets (bonds, cash, etc.).

- Allocate the remainder to growth assets (stocks, etc.) to support future cash flow needs.

- Tax-deferred assets (retirement accounts):

- More expensive source of funds from a tax perspective

- As a result, you may prefer to limit withdrawals . . .

- . . . which means that assets are likely to stay in the account longer.

- Investment implications: This fact pattern warrants a more growth-oriented approach.

- Tax-deferred assets (retirement accounts) continued:

- Note: You MUST take annual withdrawals beginning at age 72: Required Minimum Distributions

- Consider Roth conversions prior to RBD (Required Beginning Date) and during relatively low tax exposure years.

- Why a Roth IRA?

- Roth IRAs that you own are not subject to RMDs.

- Under certain conditions, withdrawals are tax-free.

- Conversions can be limited to low marginal tax rates to maximize benefits, reduce retirement assets and potentially reduce tax issues once RMDs begin.

- Charitable Gifts, like qualified Charitable Distributions (QCDs).

- Tax-exempt assets (Roth):

- The ideal investment account: no tax on gains, income, or distributions (if you comply with requirements)

- As a result, this will likely be the last account you access for cash flow

- Investment implications: your MOST growth-oriented strategy

- Note: You MUST take annual withdrawals beginning at age 72: Required Minimum Distributions

- After-tax assets (least expensive to access from a tax perspective): most conservative.

Top 3 ESOP Considerations

- ESOPs provide many tax and economic benefits to companies, owners, and employees but come with certain downsides and administrative burdens

- The advisability of an ESOP for a corporate exit or financing strategy requires broad consideration of shareholder, corporate, and employee goals and objectives

- Significant tax savings may offset the cost and other burdens of implementing and administering an ESOP

Contact us today to see if an ESOP is right for your business.

Fort Pitt Capital Group, LLC is an investment advisor registered with the United States Securities and Exchange Commission (“SEC”). For a detailed discussion of Fort Pitt and its services and fees, see the firm’s Form ADV Part 1 and 2A on file with the SEC at www.adviserinfo.sec.gov. Registration with the SEC does not imply any particular level of skill or training. You may also visit our website at www.fortpittcapital.com.

*Content is provided for educational purposes only. Opinions provided include endorsements of the products and services provided by Fort Pitt; however, are not indicative of any specific client experience or testimonial.