Investment Newsletter Third Quarter 2024

Broadening…

Equity markets quickly recovered from an ~8% decline in early August to finish the quarter at a new all-time high. In sharp contrast to the previous quarter, Q3 performance results were well distributed across market sectors and capitalization ranges. The market capitalization weighted S&P 500 Index, which is heavily influenced by the concentration to technology and tech-related sectors, climbed by 5.9%. However, the equal-weighted S&P 500 Index, which weighs each of the index components in equal proportions, posted even stronger results, advancing by 9.6%. The Magnificent Seven/mega-cap technology stocks took a breather, with most constituents ending the quarter with negative returns. Value-oriented sectors outperformed with utilities, real estate, industrials, and financials leading the charge in the third quarter.

Equity markets were well supported by a substantial decline in interest rates, firming expectations for an economic soft landing and further progress on inflation. The Federal Reserve’s long-awaited interest rate cut also played a role in solid returns and broader participation across market sectors.

Fixed income markets also responded well to these developments. Short and intermediate maturity bond indices posted mid-single-digit positive returns, while longer dated bonds and more credit sensitive segments of the fixed income universe delivered even more impressive results. Credit spreads (the difference between Treasury yields and yields offered by credit instruments with similar maturities) tightened to the lowest levels of the year as investor appetite for higher yields remained elevated.

At their September meeting, the Fed moved forward with the first interest rate cut in more than four years. While the decision to cut rates was anticipated, the call to cut by 50 basis points instead of a more conservative 25 basis points surprised many investors, us included. In addition, the Fed’s forward projections and comments from Chair Jerome Powell indicated that more rate cuts are likely in the coming months.

Kicking off the interest rate policy easing cycle with a jumbo rate cut seems to indicate the Fed declaring mission accomplished in the battle with inflation. However, with core PCE – Personal Consumption Expenditures (the Fed’s preferred inflation gauge) still hovering well above their own 2% target, it seems premature to take a victory lap. Powell explained that the slowdown in job growth was the key factor behind the decision to start with a larger-than-normal rate cut. Job gains clearly slowed over the summer months. However, weekly unemployment claims never showed signs of labor market stress and unfilled job openings still stand at over eight million. We wonder if Fed members began to rethink their view of needing to support a weakening labor market after the September Non-Farm Payrolls report showed the economy added 254,000 jobs, a result that dramatically exceeded expectations. We expect the Fed will move at a more measured pace going forward and believe markets may be overshooting a bit on expectations for the number of future rate cuts.

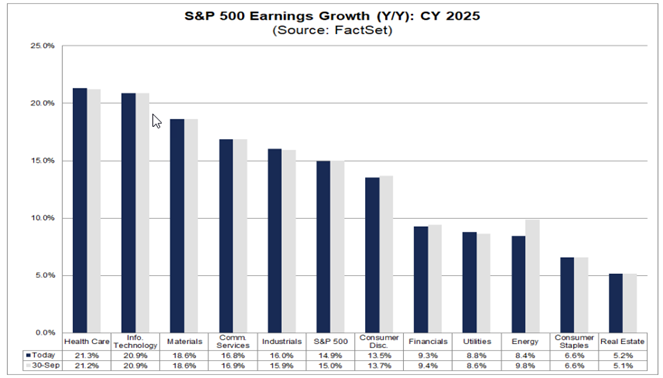

We’re at the point in the year where the focus begins to shift to next year’s corporate earnings estimates. A lot can and will change before we roll into 2025. But as of now, 2025 earnings estimates look very healthy. As the chart below shows, analysts are currently projecting almost 15% EPS (earnings per share) growth for the S&P 500 Index. Equally important, expectations point to impressive growth rates for a wide range of market sectors and not just narrow leadership from technology companies driving aggregate earnings growth for the broad market index. We think expectations for more balanced corporate earnings growth across sectors help explain the recent broadening of market participation.