Investment Newsletter Fourth Quarter 2024

Another Solid Year in the Books

This was another uneven quarter, with the S&P 500 Index higher by 2.4% while most other asset classes – large cap value, small and mid-cap, international equities, and bonds all posted flattish or negative returns. Consistent with full-year 2024 results, mega-cap technology stocks outperformed in the final quarter, propelling the tech-heavy Nasdaq and S&P indices.

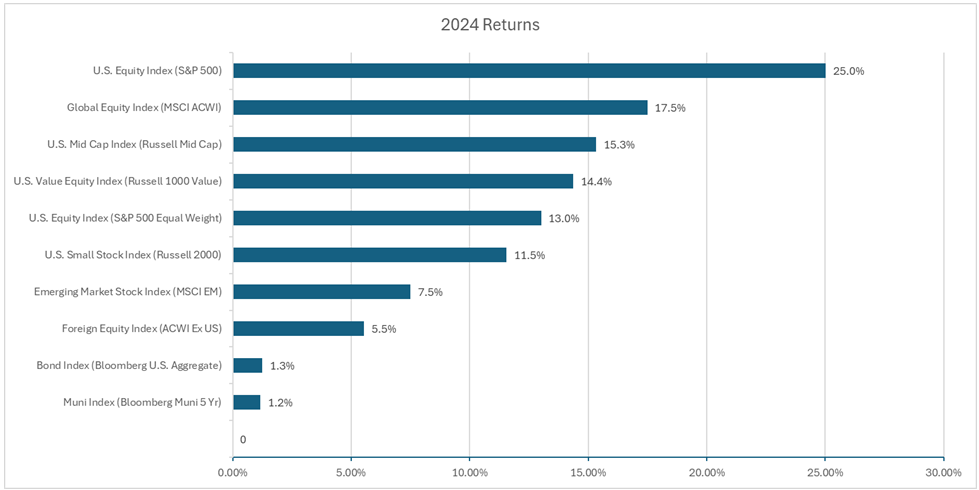

The S&P logged its second consecutive year of +20% returns, a feat that hasn’t been accomplished since 1998. Similar to outcomes in 2023, U.S. stocks dramatically outperformed international equities. Large caps dominated small caps. And growth-oriented sectors, such as communication services and technology, were the top performers. The chart below provides a good visual of the skewed results across asset classes in 2024.

Source: Orion

Stock market performance in 2024 was well ahead of our expectations for the year. Economic growth remained strong, hovering around the 3% mark for most of the year, according to data published by Apollo/Atlanta Federal Reserve. Consumers showed no signs of putting the brakes on their willingness to spend. And corporate profits reached an all-time high. We’d attribute these positive outcomes to some of the same factors at play in 2023. Consumers and corporations are simply less interest rate sensitive than in years past. Elevated interest rates are less of a concern for homeowners that have already locked in 30-year fixed-rate mortgages at 3%-4%. And corporations that borrowed massive amounts of capital at rock-bottom interest rates during the pandemic have also been unphased by higher interest rates. Amazingly, nonfinancial corporate net interest payments are near record lows even after the most aggressive Federal Reserve hiking cycle in 40 years. In addition, government deficit spending has been stimulative to the economy and has served as a measurable counterbalance to tighter monetary policy. Or, more succinctly, things held up well again in 2024.

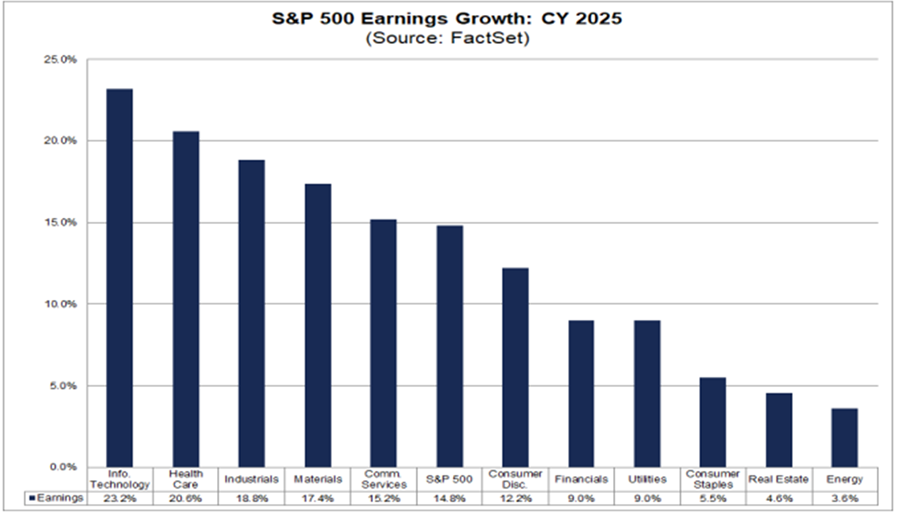

Turning to 2025, we expect the focus to be centered around how well the new administration’s policies and the bond market play together in the sandbox. So far, equity markets have embraced logical expectations for lower regulations and a continuation of a low tax regime. And those could be big positives. We feel it’s a fair (and unbiased) conclusion that the regulatory surge that took place under the Biden administration resulted in lower capital spending from businesses, restrained M&A (mergers and acquisitions), and distracted corporate management teams bogged down by Department of Justice and Federal Trade Commission inquiries/accusations. And corporate tax cuts could provide a mid-single-digit boost to already very healthy earnings growth expectations for 2025.

At the top of the list of uncertainties are tariff and immigration policies. There is a wide range of potential outcomes on the tariff front. And by design, no one knows if President Trump intends to unleash a drastic step up in tariffs in the early days of his presidency or use the threat as a negotiating tactic. We’ll have to wait and see, but if restrictive tariffs are the outcome, we would expect a negative impact on aggregate corporate earnings. There’s also the risk that immigration policy results in reduced labor supply, higher wages, and reignites inflation.

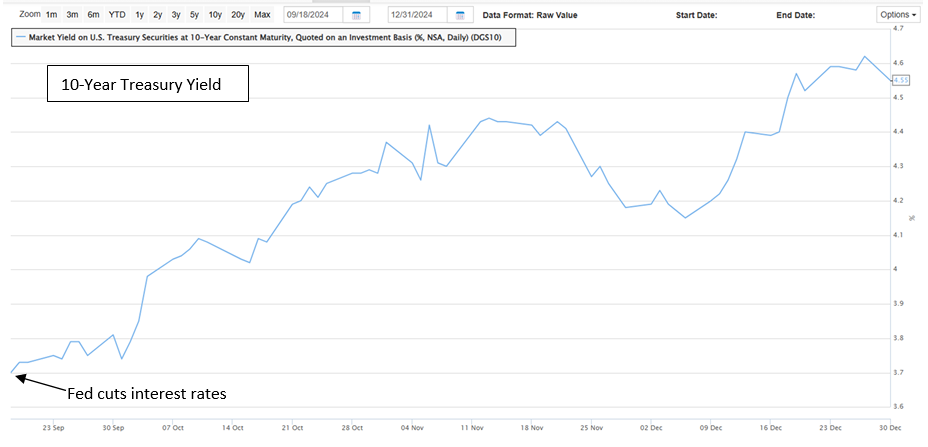

In the bond market, Treasury yields have surged since the Federal Reserve began cutting interest rates in mid-September. That upward ascent continued after the election results in early November. The bond market is sending a clear message of concern that the Fed may have turned too accommodative before the inflation problem is fully resolved and that tax cuts, tariffs, and a shallower labor pool could reverse the disinflationary trend. Investors have ratcheted down their expectations for the number of Fed interest rate cuts in 2025 to only one or two. We expect the bond market to play a key role in outcomes in 2025 and to represent a headwind to equity market advances if interest rates spike higher.

The bond market and inflation may also serve as a governor on the new administration’s agenda. The election results clearly showed Americans’ frustration and anger after four years of elevated prices. The Republican sweep of the White House and Congress may give the party a clear mandate to start the year. However, if tariff increases, mass deportations, and pro-growth policies like tax cuts result in even higher prices and borrowing costs for consumers, sentiment could shift rapidly.

Looking back at history, forward equity market returns have been significantly lower than long-term averages when valuations are as high as they are today. We’re starting the year with the S&P 500 Index trading at valuations in the 90th percentile vs. history (100% = most expensive, 0% = least expensive). History tells us to expect low-single-digit inflation-adjusted returns from this elevated starting point. Tack on 2-3% for inflation, and we expect mid-single-digit returns from broad equity markets in 2025. We expect fixed income markets to remain volatile and reactionary to developments with inflation and trade policy but also to produce positive returns for the year, driven mainly by higher coupon payments rather than substantial bond price appreciation.

Fort Pitt Capital Group is a d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC, (“Kovitz”), an investment adviser registered with the United States Securities and Exchange Commission (SEC). Registration with the SEC or any state securities authority does not imply a certain level of skill or training. Please visit www.fortpittcapital.com for additional important disclosures. Click the following for more information about Kovitz: www.kovitz.com. ©2024 Fort Pitt Capital Group. All rights reserved.

Fort Pitt Capital Group merged with Kovitz Investment Group Partners, LLC as of November 1, 2024. All Insights are opinions of the author as of the date reflected within. Any graphs, data, or information in this publication are considered reliably sourced, but no representation is made that it is accurate or complete, and should not be relied upon as such. This information is subject to change without notice at any time, based on market and other conditions. Past performance is not indicative of future results, which may vary. Actual results and developments may be substantially different from the expectations described in the forward-looking statements included herein.

The S&P 500 is a broad-based index of 500 stocks, which is widely recognized as representative of the equity market in general. The information for all other indexes shown is mean to reflect certain segments of the market. These indexes are unmanaged and may represent a more diversified list of securities than those recommended by Fort Pitt Capital Group. In addition, Fort Pitt Capital Group may invest in securities outside of those represented in the indexes. The performance of an index assumes no taxes, transaction costs, management fees or other expenses. Additional information on any index is available upon request.