Guide to ERISA Compliance

Most private employers providing retirement and healthcare benefits must comply with the Employee Retirement Income Security Act of 1974 (ERISA). However, achieving the requirements is challenging for most companies. This guide will discuss what ERISA entails and the available plans. We will also address some standard requirements, the role of fiduciaries, common challenges, and how a financial advisor can help your business.

What Is ERISA?

ERISA is a federal law that establishes the requirements for some voluntary retirement and health plans in the private sector. The law protects covered individuals by curbing the mismanagement of pension plans. Among other things, plans must provide participants with certain information, such as a description of the features and funding. Plans must also define fiduciary responsibilities, establish compliant and appeal procedures, and allow participants to sue for fiduciary duty and benefit breaches.

Congress has amended ERISA several times to expand the protections. For example, the Health Insurance Portability and Accountability Act (HIPAA) amended ERISA to protect covered persons against discrimination on health-related grounds. Also, the Consolidated Omnibus Budget Reconciliation Act (COBRA) amended ERISA to allow employees and their families to continue their employer-sponsored health coverage for a limited duration after a qualifying event.

ERISA doesn’t include group healthcare plans established by the government. It excludes plans that churches maintain for their employees or those solely maintained to comply with unemployment, workers’ compensation, and disability laws. Plans maintained outside the United States mainly to benefit nonresident aliens or unfunded excess benefit plans also do not fall under ERISA.

What Is the Purpose of ERISA?

Employers have the option to provide health insurance — there is no obligation. However, ERISA will hold you accountable for the promises made under the plan when you choose to do so. ERISA aims to ensure employers properly administer voluntary healthcare plans.

ERISA prioritizes federal reforms, streamlining compliance across the country. It sets the minimum standards and empowers the Employee Benefits Security Administration (EBSA) to enforce them. EBSA is a division of the Department of Labor (DOL) that ensures the integrity of covered plans. It investigates complaints and takes enforcement actions to safeguard the interests of participants and beneficiaries.

The Pension Benefit Guaranty Corporation (PBGC) also plays an instrumental role in ensuring the continuous receipt of pension benefits. The Internal Revenue Service (IRS) enforces provisions relating to ERISA plans in the Internal Revenue Code.

Plans Under ERISA

ERISA applies to retirement and health benefit plans:

1. Retirement Benefit Plans

There are two main classifications of retirement plans under ERISA. These are defined benefit plans and defined contribution plans. Defined benefit plans are pension or retirement plans that promise a specified monthly benefit during retirement. The benefits are fixed and pre-established. It can be a dollar amount or calculated based on the employee’s age, tenure of service, and earnings history.

Employers may contribute and deduct from their taxes annually, allowing them to provide substantial benefits. Businesses of any size can establish defined benefit plans, but the downside is that they can be complex and cost more than others.

Contrary to defined benefit plans, defined contribution plans do not promise a specified amount at retirement. Instead, the employer, employee, or both contribute to the employee’s account. The money in the account grows with any investment gains or losses. Examples of defined contribution plans are 401(k), 403(b), profit-sharing, and stock ownership plans.

2. Health Benefit Plans

Private employers provide various forms of health coverage, including group health plans and insurance coverage. Group health plans offer comprehensive coverage for hospitalization, preventive care, prescription drugs, and more. Depending on the coverage, eligible employers and their dependents may enjoy medical, vision, and dental benefits.

ERISA also applies to insurance coverage, such as health maintenance organizations (HMOs) and flexible spending accounts (FSAs). Other plans, like disability insurance, also fall under ERISA, although not employer-sponsored.

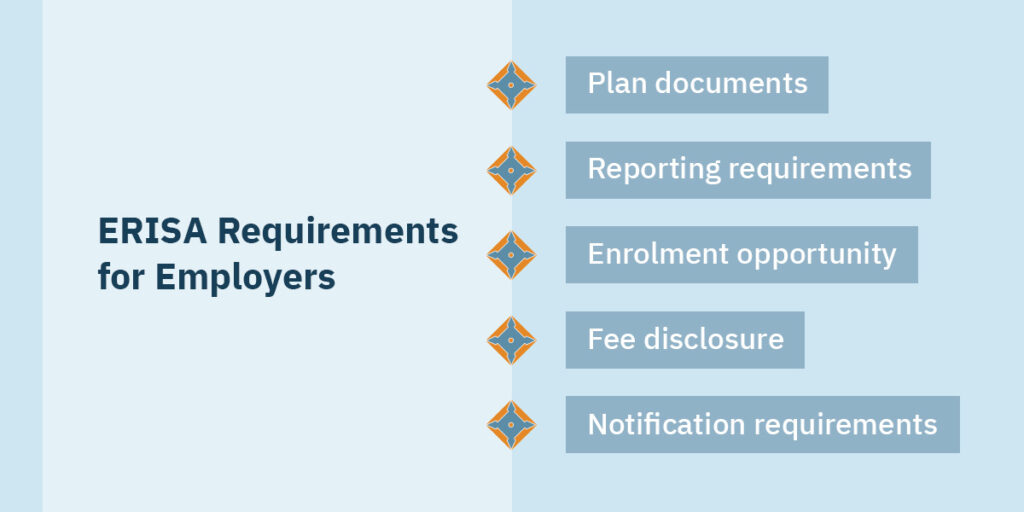

ERISA Requirements for Employers

Below are key ERISA compliance requirements employers must meet:

- Plan documents: ERISA requires employers to outline specific details in a plan document. Additionally, the plan must provide a comprehensive summary.

- Reporting requirements: Plan administrators have several reporting requirements under ERISA. For example, they must file Form 5500 annually, subject to exceptions.

- Enrolment opportunity: Employers must offer employees who meet the plan requirements the chance to enroll. Qualified employees must receive all notices, forms, and instructions.

- Fee disclosure: Employers must disclose participant fees annually.

- Notification requirements: Employers must notify participants of changes to the plan before the effective date.

The list above is not exhaustive, so consider partnering with a professional for personalized support.

Fiduciary Duties Under ERISA

Under ERISA, a fiduciary is an individual or entity with discretionary authority or control over the plan’s assets or management. Examples include employers, plan administrators, and service providers. The law sets standards for how these fiduciaries should conduct themselves, which include the following:

- Act solely in the interest of participants and beneficiaries

- Be transparent, loyal, and prudent in all their engagements

- Exercise sound judgment, diligence, and skill in managing the assets

- Diversify plan investments

- Adhere to terms in the plan documents

Fiduciaries could be held accountable or liable for breaching their duties. Depending on the circumstances, the liability could be personal. For example, a court may order them to restore losses or pay back stolen funds.

Common Challenges in Achieving ERISA Compliance

There are some potential challenges with ERISA compliance, such as:

- Complexity of rules: The laws are comprehensive and challenging to understand.

- Changes in legislation: Keeping up with the changes in law can be daunting for some businesses.

- Strict reporting requirements: ERISA demands meticulous record-keeping and reporting, which can deter some employers.

- High fiduciary standards: ERISA sets high standards for fiduciaries, imposing an added burden on employers.

- Hurdles in training and education: Many employers lack the in-house resources to train staff on the ERISA requirements.

These pitfalls exist, but you can hire a trusted advisor to assist.

How Fort Pitt Capital Group Can Help

Fort Pitt Capital Group is a team of financial advisors knowledgeable about ERISA compliance requirements. We help sponsors establish and maintain retirement plans, leveraging our resources. Our professionals can provide fiduciary oversight and investment consulting to balance risk and return. We can monitor your retirement plans and assist with employee education and audit support. You do not have to worry about legislative changes and the potential impact on your plan.

Contact Fort Pitt Capital Group for Professional Support

Private employers providing retirement and healthcare plans may have to comply with ERISA. The rules and obligations are complicated, but Fort Pitt Capital Group can help. We have decades of experience in the industry, supporting businesses in complying with ERISA and related laws.

Fort Pitt Capital Group prioritizes personalized solutions because we believe every case is unique. Want to learn more or take advantage of our efficient services? Contact us now!