Investment Newsletter First Quarter 2024

Shake it off…

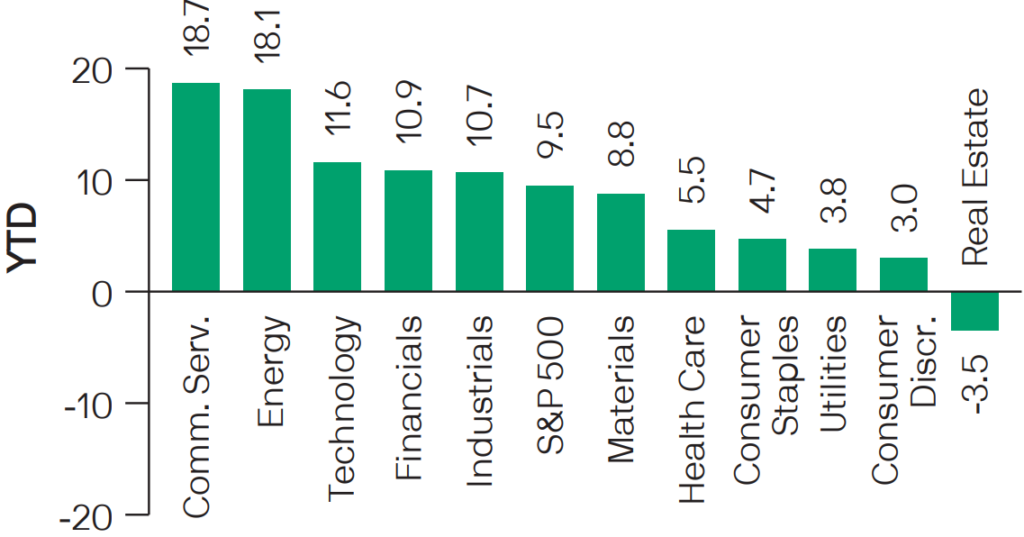

U.S. equities rallied for a second straight quarter. The S&P Index advanced by 10.6%, posting the best performance to start a year since 2019. Similar to the fourth quarter of last year, returns were more evenly distributed with broader participation across market sectors. While the technology sector and “AI” stocks continued to perform well, we did see signs of a rotation into some of the laggards from 2023 – such as – the energy, financials, industrials, and healthcare sectors. From a fundamental standpoint, we see plenty of runway for this rotation into the previously unloved sectors to continue and would view that outcome as a healthy and favorable backdrop for well-diversified portfolios.

Source: J.P. Morgan Asset Management “Weekly Market Recap” April 8, 2024. Sectors are based on the GICS methodology. Return data are calculated by FactSet using constituents and weights as provided by Standard & Poor’s. Returns are cumulative total return for stated period, including reinvestments of dividends.

Fixed income returns were mixed in the quarter. Longer duration bonds were negatively impacted by the rise in interest rates/bond yields and posted modest declines. However, shorter duration and more credit-sensitive fixed income investments posted slightly positive returns as higher coupon income and credit spread tightening were enough to offset the bump in interest rates in the quarter.

`

The economy continued to defy expectations and expand at a healthy pace. The Atlanta Fed is currently estimating a solid 2.5% annualized GDP growth rate for the first quarter. Employment growth averaged a strong 275,000 monthly additions to the payrolls over the year’s first three months. U.S. manufacturing activity expanded in March for the first time since September 2022. And consumer spending remained robust, especially within the services sector of the economy.

It’s difficult to find compelling evidence that our economy is buckling under the weight of overly restrictive interest rates. Back in January, markets were pricing in six or seven interest rate cuts in 2024. We felt those calls were wildly misguided and unrealistic unless something went horribly wrong in the financial system. The avoidance of financial catastrophes combined with better economic data, the string of robust job gains, and sticky inflation readings have led the market to dramatically reprice expectations for interest rate cuts from the Fed this year. Market pricing currently points to only a couple cuts in 2024, and we’ve recently heard several Federal Reserve Governors ponder the big question out loud – do they need to cut at all this year?

In aggregate, equity markets have taken the repricing of interest rate cut expectations in stride and have managed to shake off a string of hotter-than-expected inflation reports in short order. We’d primarily attribute that outcome to a shift in the narrative. Markets have at least temporarily moved away from the “bad news is good news” because it means faster and deeper rate cuts view. Investors are instead focusing on the view that “good news is good news” because stronger economic growth, a healthy labor market, and some residual inflation in the system are positives for corporate earnings growth. We’ll see how these dueling narratives unfold throughout the year. But we suspect the bond market will be the final arbiter. Interest rates breaking above their recent range and moving back to the highs seen last fall would present a meaningful challenge to the equity market rally.