Stock Market and Presidential Elections

The stock market allows investors to invest in high-quality companies each day. This is an effective way to grow your wealth over time, but several factors can affect how the stock market performs. It’s essential to be aware of how elections impact the stock market over the short term and what strategies you can implement for your investments to counteract stock market fluctuations.

Stock Market Before Election

Presidential elections happen every four years in the U.S., and leading up to election day, the stock market becomes more volatile. This volatility results from investor uncertainty regarding policy and regulation changes a new president can bring when they step into office.

The short-term performance of specific sectors can be unprecedented during this time, with some sectors having higher volatility than others. For instance, the healthcare industry’s stock market value can change drastically leading up to the election in anticipation of legislative change in healthcare policies. Another example is the energy sector, where changes in spending priorities dictated by the stance of the parties can increase volatility.

The election polls can also have an impact on stock markets. The market typically performs poorly when candidates tie in major polls, as this causes investor uncertainty.

Stock Market Election Predictions

Despite an individual’s political views, the odds are high that the stock markets have already priced in what will happen. This is because the stock market is a forward-looking instrument, meaning that prices will reflect investor predictions.

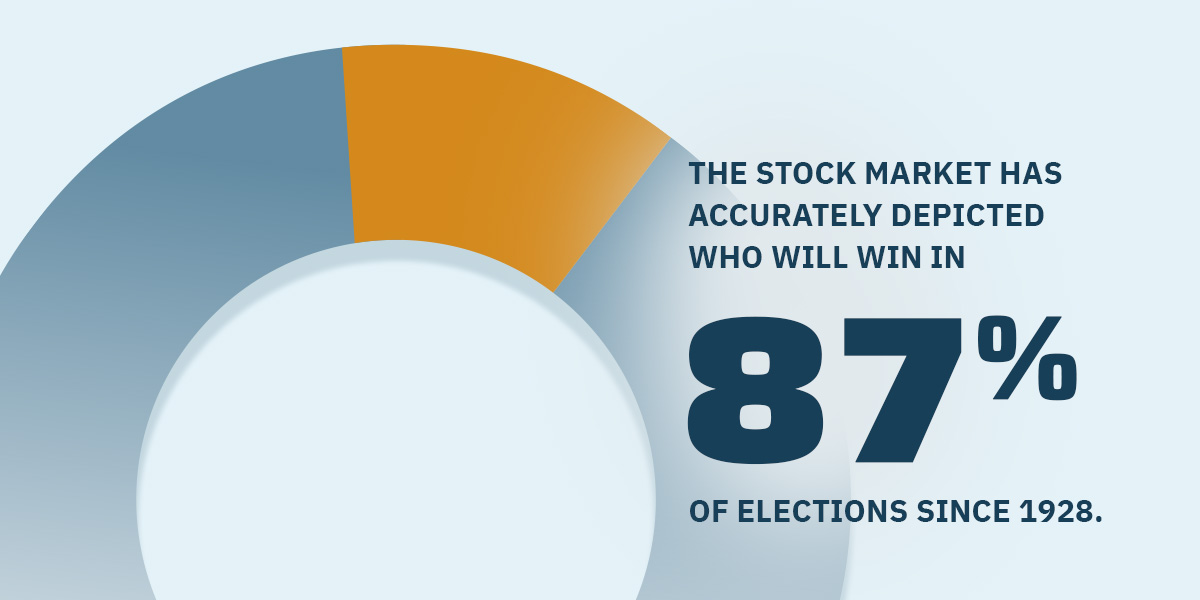

The stock market has accurately depicted who will win in 87% of elections since 1928. Data shows that the probability of the incumbent party losing is high if the stock market drops before the election. If the stock market value rises, there may be a higher probability of the incumbent parting winning.

Stock Market After Election

The stock market reacts differently depending on the type of election and which party wins. It also changes throughout the duration of the president’s full term.

The Stock Market and the 4-Year Presidential Cycle

During the four-year presidential term, the stock market seems to follow a predictable trend, which leads to the creation of the “presidential election cycle theory.” This theory states that the stock market is weak in the first half of the presidential cycle and high in the second half, particularly in the third year.

While the research to support the dip in the first half is inconclusive, the Standard and Poor’s 500 (S&P 500) — which shows the stock performance of the 500 leading companies in the U.S. — has historically shown an average gain of about 16.3% in the third year of the presidential cycle. The president will typically try to drive the market up closer to the end of their term to increase the chance of re-election, which may be a reason for the third-year gains. There are exceptions to this theory, and the data from the limited number of election cycles may not be enough to predict future patterns.

The Effect of the Winning Presidential Party

Research shows that the winning party has a minimal effect on the stock market in the long run. However, there are some cases in which there is a slight impact, especially in the months following election wins.

Generally, the stock market after elections increases more when a Republican candidate wins. However, the market has performed significantly better under Democrat presidents during their full term in office.

The market also has a brief positive reaction when the incumbent party is re-elected, especially when they’re a Democrat party.

Stock Market After Midterm Election

Midterm elections happen two years into a president’s four-year term and determine the control of the U.S. Senate and House of Representatives. Historically, the stock market performs negatively leading up to midterm elections, but recovers quickly after them. Stock market performance after midterm elections is higher than usual, with an average return of 16% for those years.

Like the presidential party, midterm election results don’t greatly impact the stock market. People may think that it’s better when one party controls both the White House and Congress, but data from past elections shows that the market performs slightly better when the Democrat party controls the White House and the Republican party controls the Congress either fully or split.

Regardless of volatility leading up to elections and the slight impact of the winning party, the stock market during election years has been favorable overall. Looking at data since 1928, 20 out of the total election years had positive returns with an average return rate of 11.58%. The stock markets posted negative returns only four times.

Investment Strategies for Elections

It’s important to remember that elections have little impact on the stock market’s overall performance over a long period of time. This is because fluctuations in returns caused by election periods even out the longer your investment period is. Despite the volatility leading up to elections and who’s in office after them, the stock market continues to provide returns year on year. Historical data from the S&P 500 index supports this notion, as it shows an average annual return rate of about 10.3% since 1957.

Rather than worrying too much about the elections, keep an eye on other factors that have a greater impact on the stock market. These include interest rates, inflation, geopolitical conflicts, and the state of the economy.

If you’re investing in the stock market, it’s essential that you:

- Stay invested: Invest for the long term in the stock markets to ensure the realization of the compounding effect of interest.

- Be consistent: The dollar cost average over time — investing set amounts at regular intervals — is better when investing in stock markets.

- Run a diversified portfolio: A diversified portfolio among sectors is one of the surest ways to insulate yourself from increased volatility.

Manage Your Wealth Through Fort Pitt Capital Group

Election time can bring uncertainty and stock market volatility, so your investments must be in the right hands. Fort Pitt Capital Group has a team of financial advisors with decades of experience in wealth management, financial planning, and investment analysis.

We’re dedicated to creating individualized investment strategies that meet your goals. Our team is always ahead of market changes, and we design our investment portfolios to mitigate the amount of loss during market decline. Through it all, we provide clear, transparent communication so you know exactly what’s happening with your investments.

Get started today by viewing our services for both individuals and businesses. When you’re ready, fill out our online form to schedule a free consultation.