How Does Multigenerational Planning Work?

How Does Multigenerational Planning Work?

With changing family dynamics across generations, financial plans should focus on the goals and intentions of individuals, couples, or families. Families are more interconnected now than ever, and multiple generations are essential to consider when creating a plan and legacy. As you continue to grow your personal wealth, it’s wise to begin thinking about multigenerational financial planning so you can help your posterity achieve fiscal security.

What Is Multigenerational Planning?

Our relationships with our parents and children connect generations and bring family lines together. Your parents worked hard to set you up for success, as their parents did for them and you do for your children. Multigenerational wealth planning makes it possible to ensure intergenerational stability.

Multigenerational wealth planning is all about managing how your wealth is transferred to younger family members when the time comes. A solid multigenerational plan will ensure that your children receive the full benefits of your life’s work so that they can do the same for their children. This plan could include anything from transferring assets to passing down the family business or sending financial gifts to younger relatives.

While implementing a multigenerational financial strategy is helpful at any point in adulthood, the concept is especially salient for individuals in a particular set of circumstances — the sandwich generation.

What Is the Sandwich Generation?

The sandwich generation refers to adults who have children under the age of 18 and living parents ages 65 and older. The name comes from the fact that these adults are metaphorically sandwiched between an older and a younger generation. Note that every generation will go through its sandwich generation period.

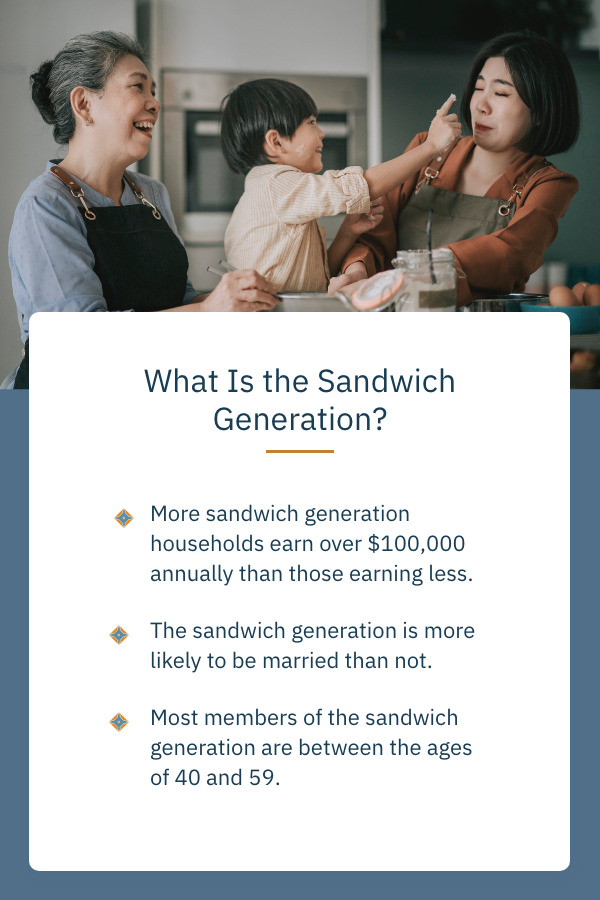

Factors like financial earnings, marital status, and age are sandwich generation determinants, according to the Pew Research Center:

- More sandwich generation households earn over $100,000 annually than those earning less.

- The sandwich generation is more likely to be married than not.

- Most sandwich generation members are between the ages of 40 and 59 — old enough to be married and have children. However, 19% are younger than 40, and another 10% are older than 60.

Financial Planning for the Sandwich Generation

If you’re currently in the sandwich generation, your position means you have various complex financial decisions to make. You’re navigating life with aging parents who are growing more dependent. Meanwhile, caring for your children is becoming more expensive each year. You have a lot on your plate, and it’s understandable to need a little assistance.

Fort Pitt helps hundreds of clients in the sandwich generation navigate their unique financial challenges through multigenerational planning. Wondering what multigenerational planning looks like? Here’s a sample of different ways we assist families across multiple generations.

The “Core” Client

Many of our clients are in the sandwich generation, between 50 and 65 years old. The term was coined because they are “sandwiched” between adult or young adult children and their aging parents.

They have their own financial needs and goals for retirement planning but also are tasked with helping children with either college plans or post-college financial planning. In addition, they are also worried about their aging parents and have elder care planning issues to consider.

Millennial Children

Parents’ primary mission is to make sure their kids are happy and healthy. But, beyond that, they want them to be financially OK.

We often work with our client’s adult children navigating a lot of “firsts” from post-college decisions on if they should live at home, rent, or buy a place to live, how to save and invest, and how to approach student loan payments, etc. The list goes on, but we’re here to help make a smoother transition into the “real world.” And once this generation has their first child, they want to start planning for their kids’ future, just like their parents did for them.

We often meet with our client’s children one-on-one, but we also have discussions about their parents’ involvement. Sometimes parents want to be involved in helping navigate the process, or parents may want their children to know what the entire family’s finances look like to get a full view of what’s going on.

We approach intergenerational planning in whatever way makes both parties comfortable so everyone can walk away confident in their future plans.

Aging Partners

When the “core” client comes to us, their parents may not have a specific advisor in place, or they don’t feel they are getting the type of advice their parents need for eldercare planning. This can be for long-term care facilities, funding a charitable trust, or help with Medicare or Medicaid.

It can be difficult and emotional to make long-term planning decisions. Whether the grandparent generation goes into independent living to skilled care or hospice, it can be expensive and is important to plan for. Many want to make sure they can protect assets for their children and grandchildren while meeting their own needs. We often coordinate with attorneys and accountants to achieve different objectives set forth.

Creating a Legacy

Through working with each generation, we have multidimensional planning conversations, which can lead to discussing a legacy.

We often help open charitable trusts, but once you make donations, you have an obligation to continue giving the gift after you pass on. This means you either have to name a child as a successor or have the trust terminate at your death and payout to charity. Bringing children into the conversation can help to educate them on charitable gifting and creating a legacy.

We often see clients prefer children to continue the legacy of gifting. It’s an excellent way to educate their children about what’s important to them. And we often hear from the children that they want to continue the good work the parents did.

Talk With an Advisor Today

At Fort Pitt Capital Group, guiding sandwich generation members through multigenerational planning is a significant part of what we do. Our Individual Services can help you navigate changes and achieve long-term financial stability for yourself and your kin. If you’re interested in speaking with an advisor about planning across multiple generations, please contact us today.

If you’re interested in speaking with an advisor about planning across multiple generations, please contact us.

Written by:

Bryson Roof, CFP®

Financial Advisor

Fort Pitt Capital Group, LLC

507 N. Front Street, Harrisburg, PA 17101

(717) 260-9281 | broof@fortpittcapital.com